Property Division in a Florida Divorce

One of the biggest stresses in filing for divorce is the concern that you will be forced to walk away without enough to maintain your lifestyle and move forward. If you are facing Divorce, you may be wondering how Property Division works. What will become of your business, your retirement accounts, the house you made a home, your car, and even your pets?

Unlike Texas, California, Nevada, and a handful of other states, Florida is NOT a community property state. In Florida, your assets, including property like your home or boat, and liabilities, like credit card debts or student loan debts, are awarded through what is called an “Equitable Distribution.” You may have noticed that the word is “equitable” and not “even”; that’s because in a Florida Divorce, the distribution of property does not have to be an exact split. In many cases, an experienced Divorce attorney can help you fight for the property you deserve.

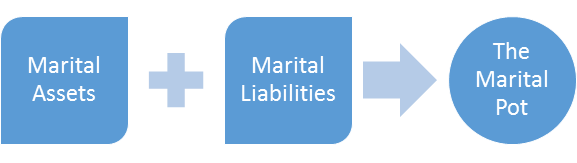

Splitting the Marital Pot

The assets that you acquired during your marriage are called marital assets. These assets along with the liabilities that were accumulated during your marriage, go into what is called the “marital pot.” This marital pot will be distributed between the two spouses equitably. Generally, any assets you acquire after one spouse files for divorce, or after the date of formal separation, are not going to be included in the marital pot or subject to equitable distribution.

Some property will not go into the marital pot, and the person that already has the property will get to keep it. Examples of property that do not often go into the marital pot include: property owned before the marriage, money from certain legal settlements, an inheritance that has remained separate from other marital money, and certain stock purchased and maintained throughout the marriage.

If you signed a Prenuptial Agreement or Postnuptial Agreement, that agreement may control what goes into the marital pot and who is entitled to what property and responsible for what liabilities. If you agreed to a prenuptial or postnuptial agreement, our attorneys can help you determine your current rights.

Valuing Significant Assets

Sometimes the parties will not agree about the value of certain property. This property may be difficult to value because it is unique, rare, or personal. Whether the property is your home, a boat, artwork, jewelry, or almost anything else you might own, an expert property appraiser or other industry expert can be used to determine a value. If the expert is qualified, your attorney may be able to have them testify in court.

Other than the marital home, one of the most common assets that is valued during a divorce is a business interest. Valuing a business interest can be accomplished using a forensic accountant or other business valuator. The attorneys with Levinson & Capuano, LLC understand small business concerns and when necessary work with small business experts to ensure that your interests are protected.

When retirement accounts are a part of the marital pot, the use of a “QDRO” or “DRO” may allow you to avoid the tax consequences of withdrawing or transferring money from your retirement account. If your marital pot includes a substantial amount of retirement assets, tax professionals and asset protection attorneys may be employed to prevent adverse tax consequences.

To speak to an experienced Divorce Attorney with Levinson & Capuano, LLC about your Property Division concerns, please call (954)703-2110 or Click Here to Contact Us.

To learn more about Divorce in Florida Choose your Next Topic:

|

|

|